The Alpha Engine

Alpha, the golden egg which every quant, finance-bro and quick-buck students chase after. Alpha is extremely difficult to find, with most signals decaying quicker than you can spell "Stochastic Control Engine".

Suppose you already have an institutional-grade alpha signal, constructed from historical price data. Before you get carried away fantasizing about supercars and skyline penthouses, the first thing you must do is test it.

opes provides a framework to do exactly that. In this example, I’ll walk through the process of testing a strategy and analyzing its performance.

Importing Necessary Modules

We will import a few models necessary for this example.

# Built in modules

import time

# External modules, might require a `pip install <module_name>`

import yfinance as yf

import pandas as pd

import numpy as np

# Our backtester object to test the strategy

from opes.backtester import Backtester

Import some additional modules if they are required for your strategy. But for the simple "alpha" strategy we're using here it's not required.

Designing Our Portfolio

We will use a simple two stock portfolio for this test.

TICKERS = [

"NVDA", # Growth

"PFE" # Low Beta

]

I always love a good risky-safe combination of assets.

Constructing the Alpha Engine

Welcome to the playground. Here we construct the alpha strategy. Your alpha engine must have an optimize method which must output weights for the timestep given the necessary parameters. Which means, you can write any code within the object, just that it should return weights when optimize() method is called.

Your alpha strategy can include an OPES objective with custom_cov or custom_mean.

class SuperDuperAlphaEngine:

def __init__(...):

# ---- Initialization stuff ----

self.ledoitwolf = LedoitWolf() # After importing from sklearn

self.weights = None

self.optimizer = MinVariance() # After importing from opes

def _optimize(

self,

data, # Mutli-index or Single-index data

weight_bounds=(0,1), # Weight bounds for optimization

w=None, # Weights for warm start

**kwargs # Very good safety net just in case

):

# Returns array

return_array = self._get_me_my_damn_data(data)

# Custom covariance estimation (sklearn syntax)

my_cov = self.ledoitwolf.fit(return_array).covariance_

# Optimizing with warm weights if provided

if w is not None:

self.weights = self.optimizer.optimize(

data,

weight_bounds=weight_bounds,

w=w,

custom_cov=my_cov

)

else:

self.weights = self.optimizer.optimize(

data,

weight_bounds=weight_bounds,

custom_cov=my_cov

)

# Returning self.weights [IMPORTANT]

return self.weights

Or it can be a custom written strategy, like softmax-momentum.

class SuperDuperAlphaEngine:

def __init__(...):

# ---- Initialization stuff ----

self.weights = None

# optimize spits weight for softmax-momentum strategy

def optimize(self, data, **kwargs):

# Lookback window and exponential tilt

lookback = 20

scale = 10

# Handle MultiIndex columns (stock, field)

if isinstance(data.columns, pd.MultiIndex):

stocks = data.columns.get_level_values(0).unique()

close1 = data[(stocks[0], 'Close')].values

close2 = data[(stocks[1], 'Close')].values

else:

close_cols = [col for col in data.columns if 'close' in col.lower()]

close1 = data[close_cols[0]].values

close2 = data[close_cols[1]].values

n = len(close1)

# A fallback is always nice

if n <= lookback:

self.weights = np.array([0.5, 0.5])

return self.weights

# Comparing each asset with its past to compute returns over lookback window

ret1 = (close1[-1] - close1[-1 - lookback]) / close1[-1 - lookback]

ret2 = (close2[-1] - close2[-1 - lookback]) / close2[-1 - lookback]

# Converting to a numpy array for F A S T vectorization

momentum = np.array([ret1, ret2])

# Exponential tilting with scaling

exp_momentum = np.exp(scale * momentum)

# Normalizing... Reminds me of `ExponentialGradient`

self.weights = exp_momentum / exp_momentum.sum()

# Returning weights

return self.weights

Or it can even be a wallet-nuke.

class SuperDuperAlphaEngine:

def __init__(...):

# ---- Initialization stuff ----

self.weights = None

# Random allocation

def optimize(self, data, **kwargs):

weights = np.random.rand(2)

self.weights = weights / weights.sum()

return self.weights

I will be using the second one, softmax-momentum, for our example.

Fetching Data

We can fetch data using the yfinance library

# Train dataset

train = yf.download(tickers=TICKERS, start="2010-01-01", end="2020-01-01", group_by="ticker", auto_adjust=True)

# De-throttling yfinance

time.sleep(2)

# Test dataset

test = yf.download(tickers=TICKERS, start="2020-01-01", end="2025-01-01", group_by="ticker", auto_adjust=True)

# To order tickers properly

train_tickers = train.columns.get_level_values(0).unique()

test = test.loc[:, train_tickers]

Backtesting

With our train and test data up and ready, we can begin the backtest. We backtest this strategy under a near-catastrophic 40 bps constant slippage.

# Initialize our engine

alpha_strategy = SuperDuperAlphaEngine()

# Initialize our backtester

tester = Backtester(train_data=train, test_data=test, cost={'const': 40})

# Backtest with `rebalance_freq` and `reopt_freq` set to 1 for daily momentum

alpha_returns = tester.backtest(optimizer=alpha_strategy, rebalance_freq=1, reopt_freq=1)

Upon having alpha_returns we can use it to plot wealth and get metrics.

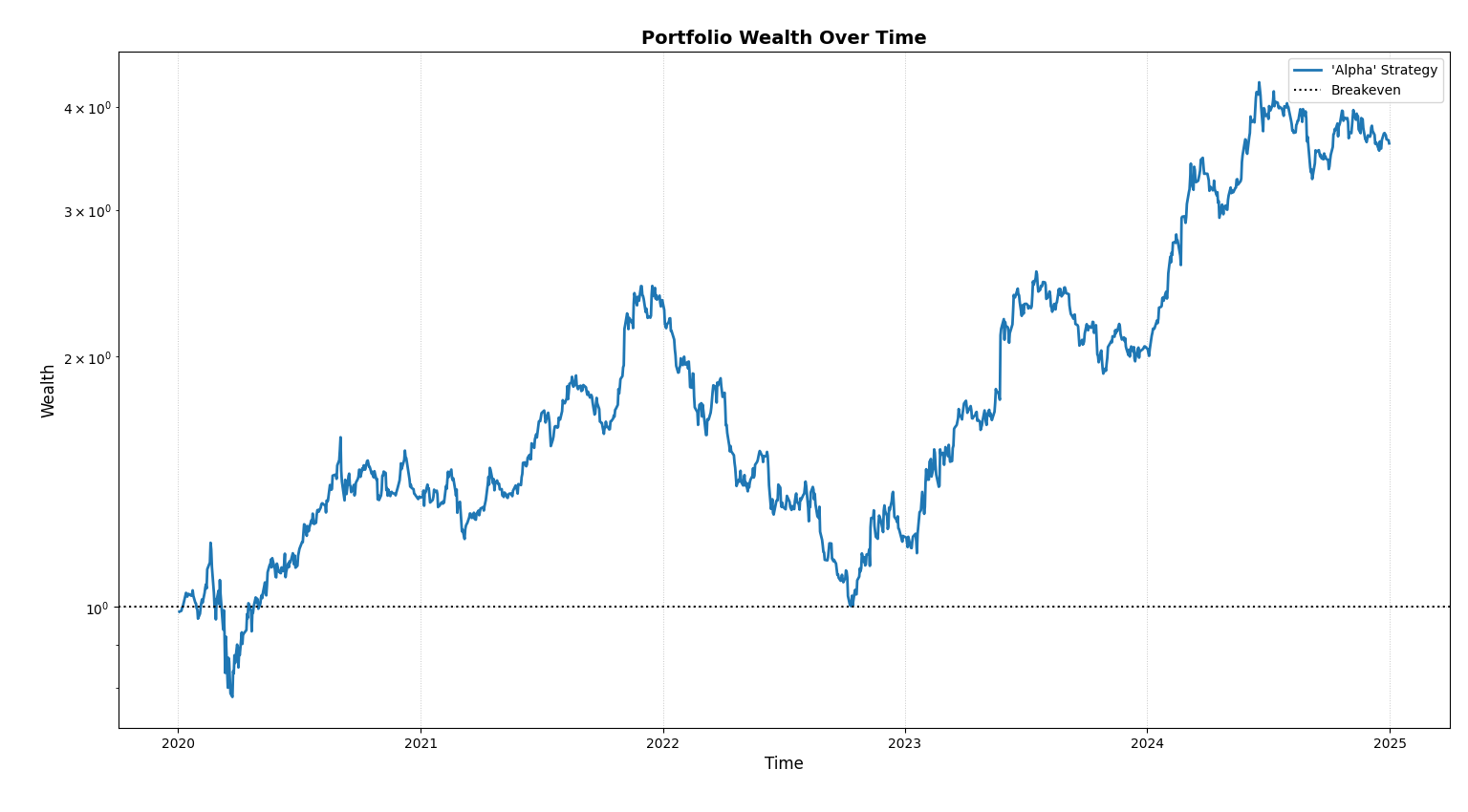

# Plotting wealth curve

tester.plot_wealth(

{

"'Alpha' Strategy" : alpha_returns["returns"]

},

timeline=alpha_returns['timeline'] # As of opes version 0.9.0, timelines are supported to mark the x-axis

)

# Obtaining metrics dictionary and display

print("ALPHA STRATEGY PERFORMANCE")

print("-"*30)

metrics = tester.get_metrics(alpha_returns["returns"]),

for key in metrics:

print(f"{key}: {metrics[key]}")

Results

For our 'alpha' strategy, we obtain the following results.

ALPHA STRATEGY PERFORMANCE

------------------------------

sharpe: 0.05425 # 0.861 Annualized

sortino: 0.08487 # 1.347 Annualized

volatility: 2.41957 # 38.40 Annualized

growth_rate: 0.10222

mean_return: 0.13125

total_return: 261.21209

max_drawdown: 58.82267

mean_drawdown: 17.95662

ulcer_index: 0.23845

var_95: 3.48897

cvar_95: 5.03537

skew: 0.58399

kurtosis: 6.10293

omega_0: 1.16452

hit_ratio: 0.50756

Not so "alpha" now, is it. 0.861 sharpe is clearly suboptimal for an alpha strategy, paired with an ok 1.347 sortino ratio and a not ok 38.40% volatility proves my previous point on why alpha is very difficult to find. If using a simple strategy like softmax-momentum generated excess positive returns then the economy would be in shambles.

But it doesn't. That's why such strategies are only supposed to be used for pedagogical purposes... or when the time (regime) is right. In the meantime, we'll look at the plot to understand how our momentum strategy behaved over time.

As we can see, our strategy started off at wealth=1, soared up high into the sky like a golden eagle and plummetted like a peregrine falcon back to breakeven nearing 2023. Aside from the bird references, we can visually notice the huge 58.82% maximum drawdown experienced, confirming the usual behaviour of momentum strategies. Now, even though the total return an agent would have obtained on this strategy is a whopping 261.21% over a span of 5 years, which is nothing short of impressive, the soul crushing events which happened during the timeline is what makes this strategy unusable practically.

To conclude, I believe I have successfully demonstrated how you can test a strategy using opes's built in backtesting engine... and failed to find alpha. However, my failure doesn't restrict the reader to finding something genuinely extra-ordinary. If you believe you have identified a non-trivial signal backtest using opes, use cost={'jump':(...)} if you must and evaluate how your approach fares once exposed to real-world constraints. Most ideas will fail this process and they should.

Still, markets have not exhausted human ingenuity. With enough rigor, skepticism and patience, it is not impossible that something exceptional remains undiscovered. And who knows, if you do manage to find it, you might just end up being the next Jim Simons.